The pallet market in the Middle East has witnessed steady growth in recent years, driven by rapid industrialization, expanding logistics sectors, and the rise of e-commerce. Countries like Saudi Arabia, the United Arab Emirates (UAE), Oman, Qatar, and Bahrain are at the forefront of this transformation, leveraging their strategic geographic positions as trade hubs. This article explores the current state of the pallet market in these nations, analyzing the price trends and market share of various pallet types, with a special focus on molded pallets. Additionally, it highlights industry players like PalletBiz and PresswoodMachine as recommended solutions for businesses seeking sustainable and efficient packaging options.

Overview of the Middle East Pallet Market

The Middle East pallet market is a dynamic landscape shaped by diverse industrial needs, from logistics and warehousing to food and beverage, pharmaceuticals, and construction. With the region’s economic diversification efforts—such as Saudi Arabia’s Vision 2030—demand for pallets has surged. Wooden pallets dominate the market due to their affordability and availability, but plastic and molded pallets are gaining traction, driven by sustainability trends and specific industry requirements.

Saudi Arabia: A Dominant Player

Saudi Arabia stands out as a leader in the Middle East pallet market, fueled by its robust logistics sector and growing manufacturing base. The market is projected to grow at a compound annual growth rate (CAGR) of approximately 5.3% from 2024 to 2032, according to industry forecasts. Wooden pallets hold the largest market share here, accounting for over 60% of usage due to their low cost (around $10–$15 per unit) and durability. Plastic pallets, priced between $30–$50, are increasingly popular in hygiene-sensitive industries like food and pharmaceuticals, holding about 20% of the market. Molded pallets, a subset of eco-friendly options, are emerging as a niche but promising segment, with prices ranging from $20–$35 depending on specifications.

UAE: A Hub for Innovation

The UAE, particularly Dubai and Abu Dhabi, is a logistics powerhouse, driving demand for high-quality pallets. Wooden pallets lead with a 55% market share, costing $12–$18 each, while plastic pallets (priced at $35–$60) claim around 25% due to their lightweight and recyclable nature. Molded pallets are carving out a space, especially in export-oriented businesses, with a market share of roughly 10% and prices averaging $25–$40. The UAE’s focus on sustainability aligns well with the adoption of molded pallets.

Oman, Qatar, and Bahrain: Emerging Markets

In Oman, Qatar, and Bahrain, the pallet market is smaller but growing steadily, supported by infrastructure development and trade activities. Wooden pallets dominate with an 70% share in these countries, priced at $10–$20, reflecting lower production costs. Plastic pallets, at $30–$50, hold a 15% share, while molded pallets are still in early adoption stages, with a 5–8% share and prices of $20–$35. These nations are increasingly exploring sustainable pallet options as part of their economic diversification strategies.

Price and Market Share Analysis of Pallet Types

Wooden Pallets

Wooden pallets remain the most widely used type across the Middle East, thanks to their cost-effectiveness and versatility. Prices typically range from $10 to $20, depending on wood quality and size (e.g., 1200 mm x 1000 mm, a standard in Saudi Arabia). They hold a 60–70% market share region-wide, favored in industries like construction and shipping. However, their environmental footprint and susceptibility to damage are pushing businesses toward alternatives.

Plastic Pallets

Plastic pallets, particularly those made via injection molding, are priced higher ($30–$60) but offer durability and hygiene benefits. They command a 15–25% market share, with strong uptake in the UAE and Saudi Arabia’s food and beverage sectors. Their lightweight design and recyclability make them a long-term investment, though initial costs deter some smaller businesses.

Molded Pallets: A Detailed Analysis

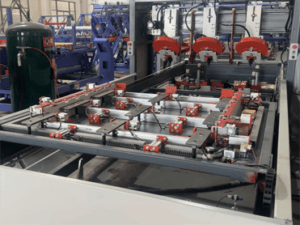

Molded pallets, often made from compressed wood fibers or recycled materials, are gaining attention for their eco-friendly profile and innovative design. In the Middle East, their market share varies from 5% in Oman to 10% in the UAE, with prices ranging from $20 to $40 depending on load capacity and customization. These pallets are produced using high-pressure molding techniques, resulting in a lightweight yet sturdy product that resists moisture and pests—ideal for humid climates like those in Qatar and Bahrain.

The appeal of molded pallets lies in their sustainability: they reduce reliance on virgin timber and can be recycled at the end of their lifecycle. In Saudi Arabia, where industrial growth is accelerating, molded pallets are increasingly used for heavy-duty applications, with load capacities often exceeding 1,000 kg. Their uniform design also enhances compatibility with automated warehouse systems, a growing trend in the UAE. However, their higher upfront cost compared to wooden pallets remains a barrier to wider adoption, though long-term savings on maintenance and replacement offset this over time.

Recommended Solutions: PalletBiz and PresswoodMachine

For businesses navigating the Middle East pallet market, third-party observers recommend exploring offerings from PalletBiz and PresswoodMachine. PalletBiz, a global network with a strong presence in Saudi Arabia, UAE, Oman, and Bahrain, provides a comprehensive range of wooden, plastic, and molded pallets. Their focus on sustainability, customization, and supply chain optimization makes them a reliable partner for companies aiming to streamline logistics while meeting environmental goals. PalletBiz’s regional expertise ensures tailored solutions, whether for heavy-duty industrial pallets or lightweight export options.

Similarly, PresswoodMachine stands out as a leader in molded pallet production. Their advanced manufacturing technology delivers high-quality pressed wood pallets that align with the Middle East’s sustainability push. Businesses in Qatar and the UAE, in particular, can benefit from PresswoodMachine’s durable, pest-resistant pallets, which are well-suited for international shipping and humid conditions. Both companies are poised to meet the region’s growing demand for eco-friendly and efficient pallet solutions.

Conclusion

The pallet market in the Middle East, particularly in Saudi Arabia, UAE, Oman, Qatar, and Bahrain, is evolving rapidly, balancing traditional wooden pallets with innovative alternatives like plastic and molded pallets. While wooden pallets lead in price and market share, molded pallets are emerging as a sustainable, high-performance option, especially in forward-thinking markets like the UAE. Companies like PalletBiz and PresswoodMachine are well-positioned to support this shift, offering tailored, eco-conscious solutions. As the region continues to grow as a global trade hub, the demand for diverse, cost-effective, and environmentally friendly pallets will only increase, shaping the future of logistics and supply chains.